The COVID-19 pandemic has demonstrated the need for building owners to stay agile and preserve capital. Enter LaaS. How it works and the pros and cons

By Roshni Nair

The COVID-19 pandemic shined a spotlight on the need for companies and building owners to maintain flexibility—both in terms of how they manage their space and their capital. In the lighting industry, one example is the continued growth of the lighting-as-a-service (LaaS) model, which allows owners to repair, retrofit or upgrade their systems without drawing down capital. In the process, emerging new systems with germicidal UV luminaires—to name just one example—can be added into the program without large capital spends. Further, once the lighting is in place, the reduction in operating expense acts as a second driver of LaaS. The U.S. government has also implemented several rules and regulations related to improving energy efficiency in existing and new building projects.

The LaaS model offers several advantages. First, without the need for capital investment, the owner can install or upgrade its lighting system with the help of a LaaS provider who offers a multi-year contract on a subscription basis for the services provided. This can translate into substantial longterm savings, as the cost incurred for lighting products and services can be shown as an operating expense. With these savings come the potential for technology enhancements including:

- 1. Germicidal UV. Germicidal UV is generally used to kill microbes that are present in the air, water and on other surfaces. Germicidal lamps produce wavelengths similar to UV rays that have disinfection properties. Installation of germicidal UV systems is quite expensive which also requires high capital investment. Adoption of LaaS enables the installation of these systems at the facility without the initial investment. It is being widely adopted in healthcare facilities, educational institutions, hospitality, food and beverage, service and processing centers, and the commercial/industrial sectors.

- 2. Asset Management. The LaaS provider’s asset management software can be used to monitor and manage all exterior lighting installations using a single dashboard. This asset management software automatically detects any faults in the system along with software updates for the same. This technology can be used to generate robust asset inventory and repair logs. It can also track any changes in the hardware and system performance.

- 3. Solar Lighting. Developments in solar lighting for exterior application, as well as pairing with additional self generation and battery storage systems is going to change the format for LaaS in a positive way. Cash flow savings generated from the use of LaaS for solar lighting can then be redirected to other areas of the business.

- 4. Wayfinding Software & Hardware. Advanced technologies such as accurate indoor positioning systems, powered by the technology embedded in LED luminaires, will enable services such as wayfinding, location assistance requests, etc. In a commercial/industrial setting, it supports staff productivity with improved workflow. Data is fed into the software and is provided to the user via the networked LED luminaires at the facility.

- 5. Wireless Sensor-Based Network. WSN is still in the nascent stage, as installation of these networks requires huge initial investments from the lighting companies as well. Demand for WSN in smart lighting systems is expected to increase, owing to developments in the sensor technologies, which will help remove unnecessary complications in the technology. WSN is anticipated to have a market share of $4 billion by 2025.

Despite the benefits of LaaS, there are possible obstacles to adoption:

- Short-term Savings. Cost savings are obtained in the form of energy savings; however, the monthly subscription cost of the LaaS model does not allow for realization of these cost savings in the short term. There is a need to wait for several years to show substantial cost savings through the LaaS model.

- Monthly Charges. Agreements are entered into by both parties, the owner and the LaaS provider/financing companies, for the repayment of the investment made at the facility. A subscription model is the method of repayment in the majority of cases. However, this subscription fee becomes an unavoidable monthly expense for the entire term of the contract which is generally long term. This is a major constraint for the adoption of LaaS for several companies.

- Financing Terms. The owner is expected topay interest on the investment made by the LaaS financier. This amount is included in the monthly subscription fee. Some owners may be reluctant to pay interest on the products and services, as they tend to become costlier than the initial capital investment required by them in a normal setting.

Adoption of LaaS across industries globally is in the nascent to developing stage. Several owners are in discussion with LaaS suppliers owing to the short- and long-term benefits offered by LaaS. Changes in regulations pertaining to energy management and increased sustainability in several developed and developing countries is also a major driver to the adoption of LaaS. The highest adoption of LaaS is in European countries followed by North America and other developing countries such as China, Singapore, Australia and India.

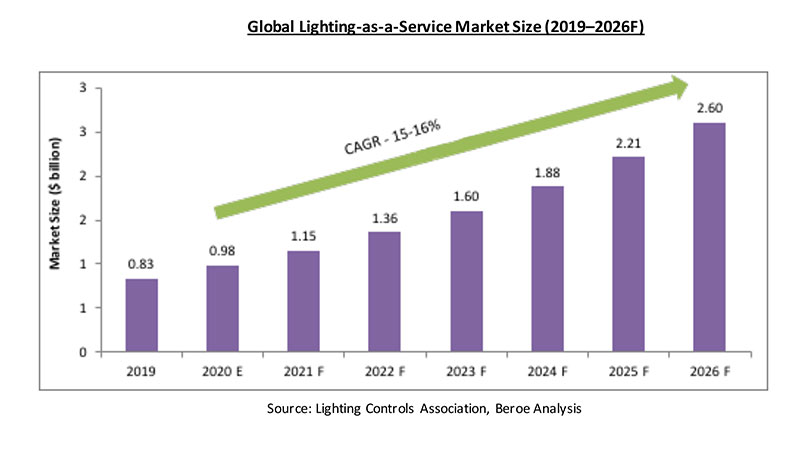

Indeed, the trend line appears to be pointing up. According to the Lighting Controls Association, the LaaS sector is expected to grow at a CAGR of 15-16% from 2020 to 2026 (Figure 1). The growth rate is anticipated to be exponential after two-to-three years due in part to better financing terms by the LaaS suppliers.

North America may see greater growth in the next two-to-three years due to lack of liquidity in the capital markets among small-to-medium businesses owing to the negative effects of COVID-19. The growth is expected to be over 20% post-pandemic, according to an analysis by the consulting firm Beroe. Small-box retailers, the hospitality sector, the food-processing sector and commercial offices are expected to the lead the way.